[ad_1]

Fitch Rankings forecasts a 4% progress for Sub-Saharan Africa in 2024, signifying a gradual financial development.

This progress aligns with the five-year common as much as 2019, though it’s barely decrease than the strong development previous to 2014.

The evaluation highlights a impartial development in scores for the area, indicating secure financial circumstances.

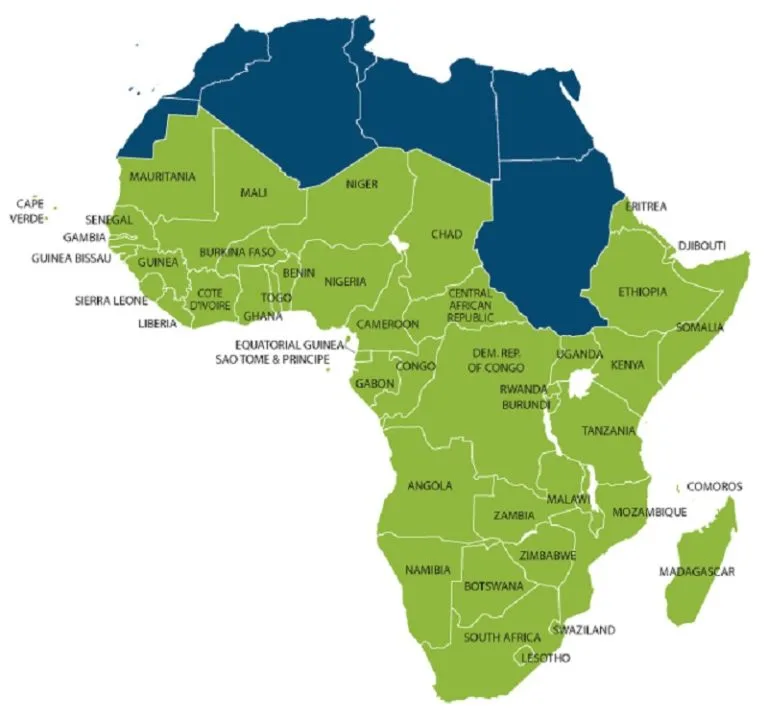

Regardless of the general common progress, there are notable variations among the many 20 international locations analyzed.

Seven of those international locations are anticipated to develop at charges equal to or exceeding 5.5%, illustrating the varied financial landscapes inside the area.

Key dangers recognized embrace financing constraints, climatic occasions, and the opportunity of slower world progress impacting African economies.

These components underscore the interconnectedness of world and regional financial dynamics.

Inflation within the area is projected to decelerate, reducing from a excessive of seven.4% in 2022 to an anticipated 4.9% subsequent 12 months.

This anticipated lower in inflation may contribute positively to financial stability throughout the area.

Concerning public debt, Fitch expects a stabilization of 67%.

This prediction relies on ongoing fiscal consolidation efforts supported by Worldwide Financial Fund applications in lots of international locations.

The stabilization displays concerted efforts to handle fiscal challenges successfully.

Nations within the area have public debt exceeding 70% of their GDP

The debt-to-GDP ratio on this area is maintained at 67%, larger than pre-pandemic ranges, indicating the long-term influence of the pandemic on the area’s economies.

This stage of debt highlights the significance of continued fiscal administration and financial reforms.

The report additionally notes that half of the Fitch-rated international locations within the area have public debt exceeding 70% of their GDP.

This excessive debt ratio presents ongoing challenges and underscores the necessity for cautious fiscal planning and administration.

The evaluation concludes that the typical debt-to-revenue ratio will stay above 300%, suggesting that tax revenues cowl solely a 3rd of debt servicing prices.

This statistic factors to the continuing want for financial reforms and environment friendly tax assortment to make sure regional fiscal sustainability.

[ad_2]