[ad_1]

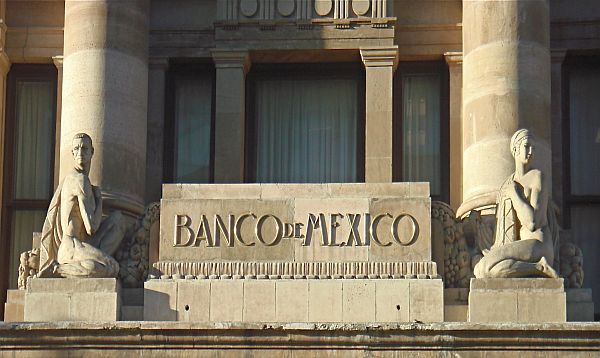

Mexico’s financial areas will persist of their restoration endeavors, albeit inside a “advanced and unsure” milieu, primarily as a result of U.S. financial outlook, as famous by the Financial institution of Mexico (Banxico).

The “Report on Regional Economies” introduced by Banxico’s Basic Director of Financial Analysis, Alejandrina Salcedo, highlighted a few of the principal dangers confronted by Mexico.

These embody the potential decline in exterior demand, stemming from an anticipated slowdown within the U.S. economic system.

“Such a downturn might adversely have an effect on export-oriented entities within the northern and central areas or people who obtain a big move of remittances or vacationers from the U.S., equivalent to some entities within the north-central and southern areas,” the report elaborated.

Moreover, a brand new provide shock, led to by public safety points that would impede corporations’ operations in crime-prone areas, poses one other problem.

Banxico confused the need for Mexico to domesticate favorable funding circumstances and bolster these elements influencing inner progress drivers.

“Particularly, the continuous reinforcement of the rule of legislation, together with relentless efforts to fight insecurity and corruption, might stimulate the inflow of investments not solely from areas historically identified for receiving a bigger portion of those flows, but additionally from the south,” it recommended.

“To buttress this course of, ongoing infrastructural growth tasks, particularly these enhancing regional connectivity with different markets inside and past Mexico, ought to be pursued,” it added.

As per revised official figures, Mexico’s economic system, which ranks second in Latin America after Brazil, noticed a 3.0% progress in 2022.

Personal analysts surveyed by Banxico anticipate a 2.0% growth in Mexico’s economic system in 2023, attributed to a projected deceleration within the U.S.

[ad_2]