[ad_1]

The World Financial institution has flagged The Gambia’s and Mozambique’s state-owned enterprises (SOEs) as a monetary hazard to the nation’s economic system.

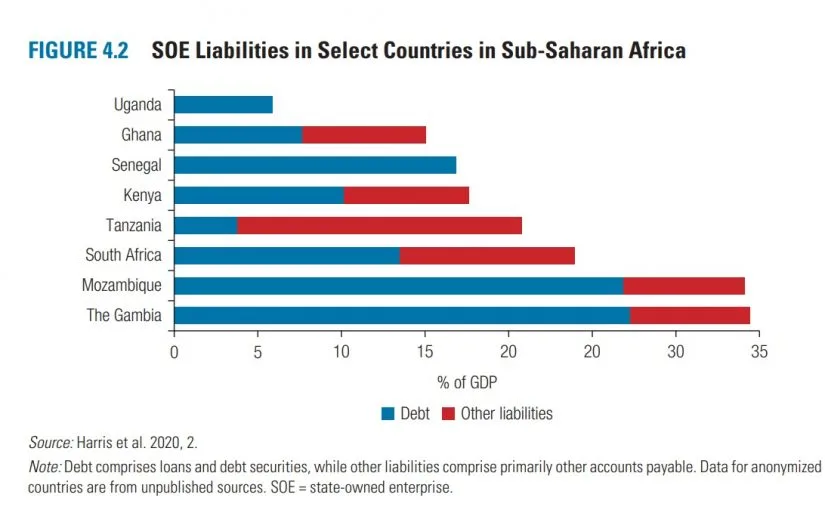

In an in depth research, they observe these entities make up an unlimited 35% of those international locations’ GDP.

Their report, The Enterprise of the State, covers over 76,000 public firms in 91 nations.

It warns of potential financial crises stemming from SOEs’ fiscal points, like deficits and money owed.

In Sub-Saharan Africa, SOEs’ revenues are sometimes 7% of GDP. Their belongings and liabilities are about 34% and 20% of GDP, respectively.

This massive financial position sparks debates on the state’s enterprise involvement.

The report examines the state’s twin position within the economic system. It notes how state corporations, as seen in Angola and Nigeria, generally assist public wants.

These corporations have ensured important companies like electrical energy are accessible. Nevertheless, the report additionally reveals circumstances the place state corporations exploit their place.

An instance is Angola’s cement sector, the place state involvement limits competitors. This impacts personal funding and development.

The Gambia and Mozambique’s expertise is a main instance.

The Gambia

Gambia’s state enterprises face substantial monetary dangers because of excessive money owed, operational inefficiencies, and unstable revenues.

Extra challenges embrace political interference, lack of transparency, intense market competitors, regulatory shifts, and world financial fluctuations.

Addressing these points to make sure monetary stability and bolster nationwide financial well being necessitates reforms like enhancing administration effectivity and transparency.

Moreover, restructuring money owed could also be an important step on this course of.

Mozambique

Following the 2016 ‘hidden money owed scandal,’ the nation confronted a extreme monetary disaster.

The Fiscal Dangers Report by Mozambique’s Threat Administration Directorate factors out the monetary hazard from its State Enterprise Sector (SEE).

Particularly, three firms are main issues for 2024. Nevertheless, there was an enchancment in 2022.

Resulting from their fragile circumstances, LAM, Petromoc, and TMCEL proceed to pose monetary dangers. This case in The Gambia and Mozambique mirrors world issues about SOEs.

International Issues About SOEs

Traditionally, many international locations have struggled with balancing state and personal sectors. A key problem is making certain SOEs don’t undermine truthful competitors.

Efficient SOE administration has diversified globally, reflecting completely different financial and political contexts.

By way of benchmarking, Mozambique’s SOE debt discount in 2022 is a constructive signal. This contrasts with conditions in some international locations the place SOE money owed have escalated.

Evaluation means that proactive administration and transparency are essential for fulfillment. The World Financial institution’s give attention to this concern highlights its significance in world financial stability.

Studying from historical past, it’s clear that balancing SOE roles is significant for sustainable financial development. This case gives beneficial classes for different international locations going through related challenges.

[ad_2]