[ad_1]

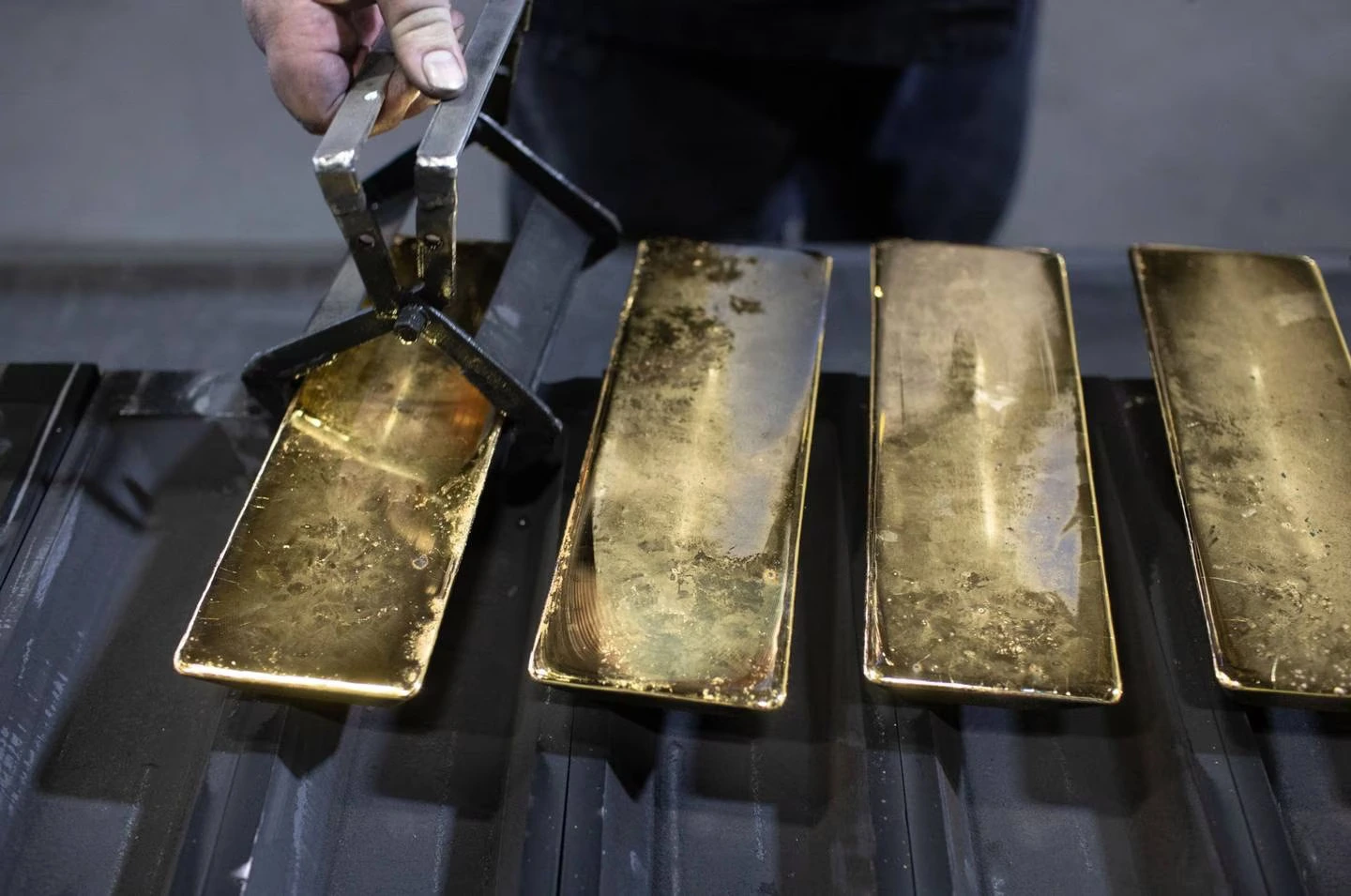

Gold hit a two-month peak, pushed by poor U.S. manufacturing knowledge and declining shopper confidence, suggesting potential rate of interest cuts.

February’s sharp lower in U.S. manufacturing facility exercise, alongside the primary drop in shopper confidence in three months, signaled financial issues.

The financial downturn triggered Treasury bond yields to fall, pushing gold costs up by 1.3%, the most important rise since mid-January.

This situation fueled hypothesis that the Federal Reserve would possibly scale back borrowing prices, impacting non-yielding bullion negatively.

Federal Reserve officers’ remarks additional propelled gold. Governor Christopher Waller expressed a desire for rising short-term Treasury holdings.

Austan Goolsbee from the Chicago Fed commented on the restrictive nature of the present funds price.

Each Thomas Barkin from Richmond and Lorie Logan from the Dallas Fed shared insights on potential price cuts and stability sheet methods, shaping market expectations.

By Friday, spot gold was up 1% to $2,073.31 an oz., aiming for an additional week of features.

Will increase in silver, platinum, and palladium highlighted the wide-reaching results of financial studies and Federal Reserve statements on treasured metals.

This sequence illustrates the shut hyperlink between financial knowledge, financial coverage choices, and the commodity market, with gold performing as a refuge throughout financial uncertainties.

Background

This surge in gold costs amid financial uncertainties will not be an remoted phenomenon; it’s a development noticed traditionally in periods of monetary instability.

Gold, typically seen as a protected haven, tends to understand when confidence in conventional investments wanes.

This sample displays broader financial dynamics the place buyers search stability in tangible property.

The latest financial knowledge from the U.S., indicating a slowdown, has international implications.

Comparable downturns have prompted central banks worldwide to regulate financial insurance policies, typically resulting in elevated curiosity in gold.

This dynamic underscores the interconnected nature of

[ad_2]